Why Green Lantern Capital?

Over 80 years of market experience

Over 80 years of market experience

The Fund Management Team consists of market veterans with a collective experience of over 80 years and worked with various companies....

Read More...

Risk Conscious Investment Approach

Risk Conscious Investment Approach

We at Green Lantern Capital have a risk-conscious approach focusing on the global and domestic macro scenario, valuation, earnings, and balance sheet risk.

Read More...

Deep Research & Flexibility

Deep Research & Flexibility

The Fund Management Team is always interested in finding suitable companies by focusing on good businesses....

Read More...

Skin in the game

Skin in the game

The Fund Management Team has invested a significant part of its corpus in its own funds.

Read More...Offerings & Services

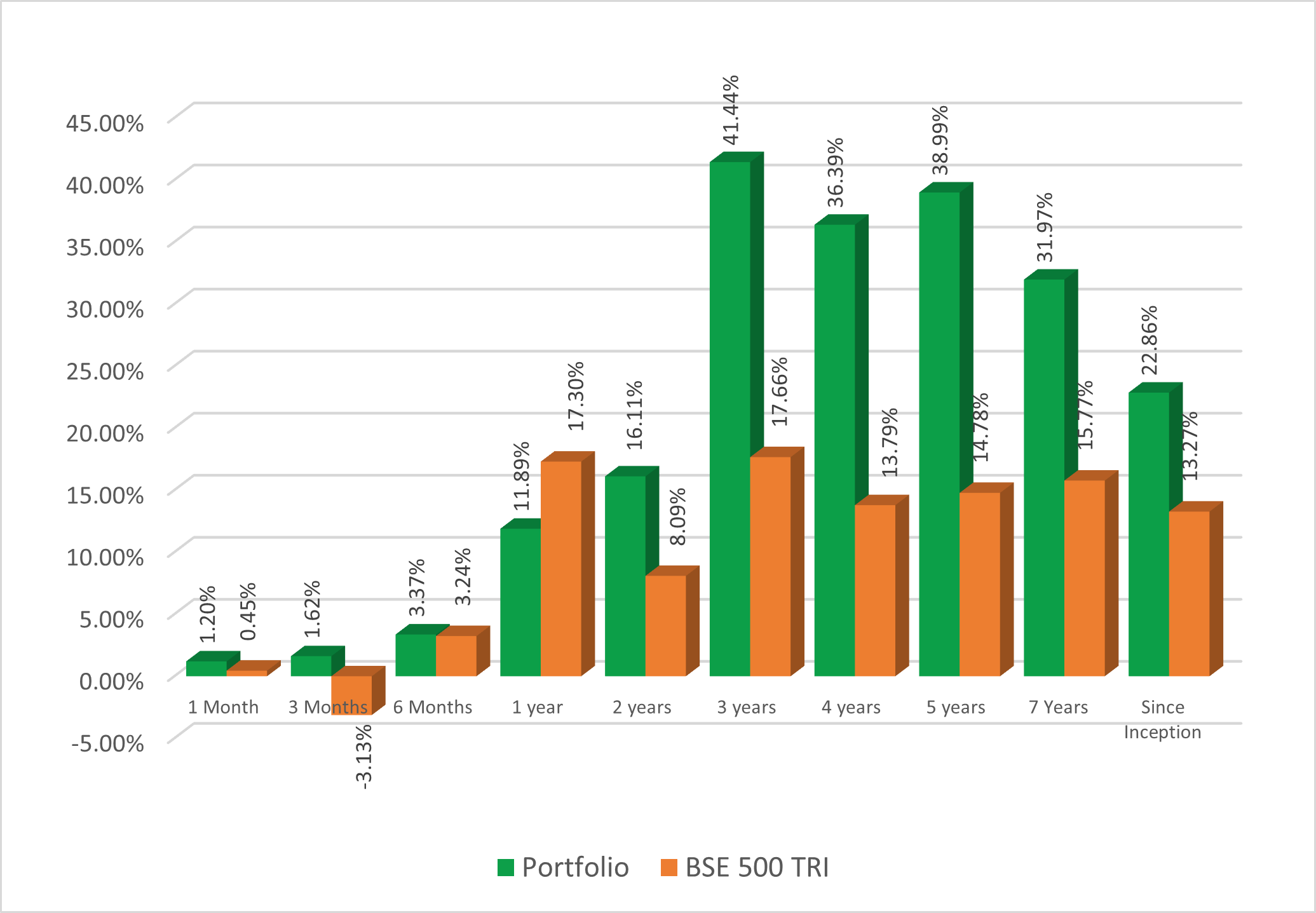

Growth Fund

The fund strategy endeavors to generate superior risk adjusted returns, in varying market conditions, by investing in Mid & Small Cap companies.

Read More...

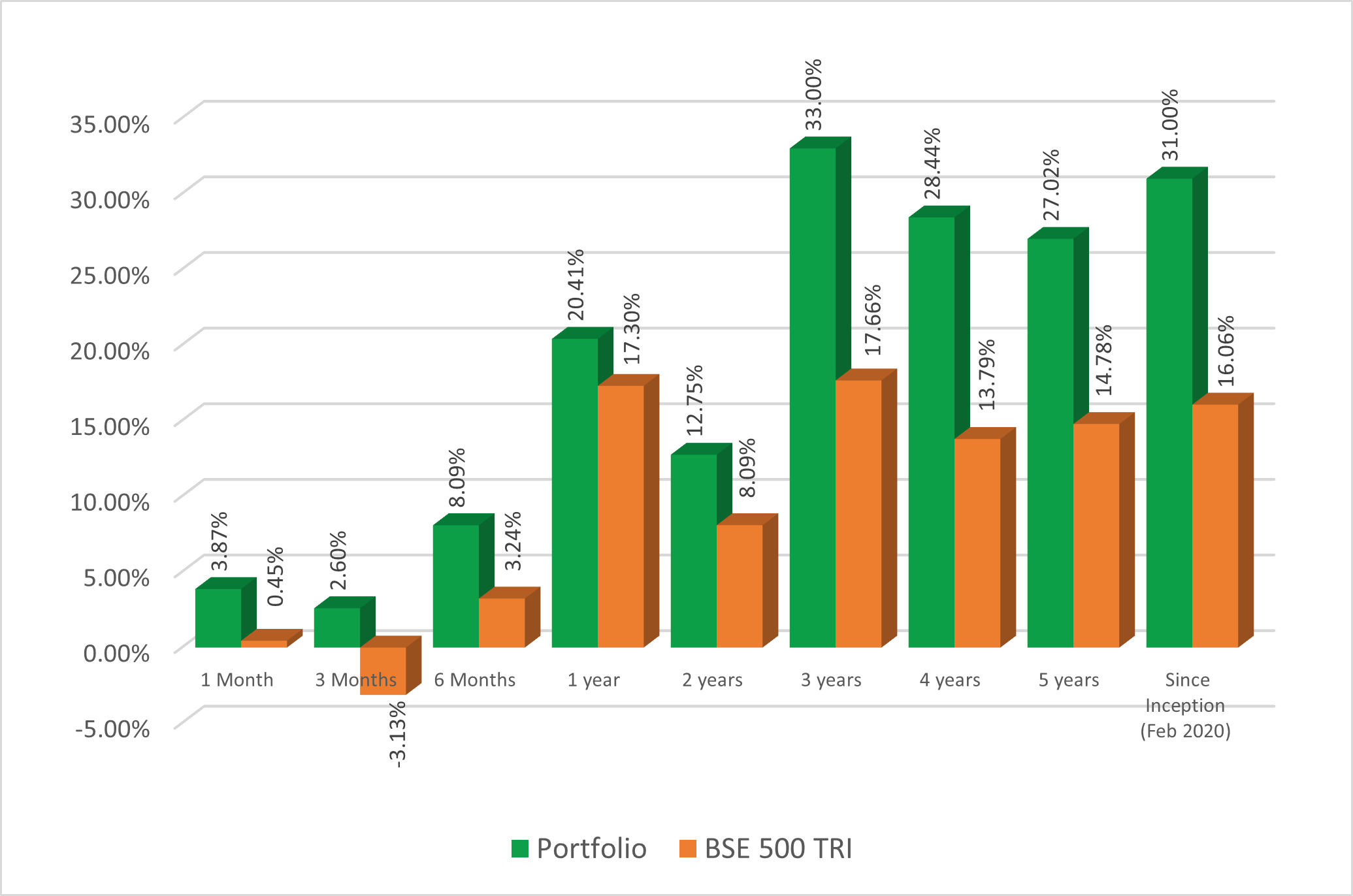

Alpha Fund

The fund strategy endeavours to generate superior risk-adjusted returns, in varying market conditions, by investing in large Mid-Caps within a broad Multi-Cap allocation strategy.

Read More...Latest Performance

Performance Data as of 28th February 2026.

*Returns over 1 year period are annualized. Returns are adjusted for inflows/outflows. Performance is calculated after expenses and it is TWRR.

Our Partners

Green Lantern Capital LLP is proud to associate with these companies, who provide outsourced support services.

Contact Us

Have a question? Fill out the form and we will get back to you shortly.